Actor Bruce Willis is among the thousands of Big Apple residents who may have overpaid their property taxes due to a new $18 million Department of Finance computer system that issued incorrect bills in early June.

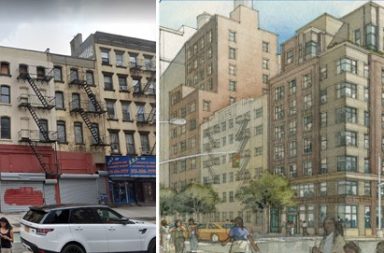

The “Die Hard” actor, whose advisers paid the tab for his new $7.3 million condominium at 1 West End Ave. prior to the July 1 due date, overpaid by $36,283, records show.

That’s because the city’s new computer system issued property tax bills without including the 421a tax abatement, which gives developers and condo owners a tax break for building on underutilized land.

Without the 421a exemption, Willis’ annual taxes would have been $75,067. With the exemption, the actor and wife Emma Heming Willis will pay roughly $5,000 a year, with steady increases until they pay the full freight.

The couple’s 242 neighbors at 1 West End Ave. and others are likely in the same boat, thanks to the aptly named Property Tax System or PTS, which has created post-traumatic stress chaos for many property owners, attorneys and Department of Finance staffers working to correct its shortcomings.

“The irregularities are systemic and impact every class of property. The computer should have never come online before it was perfected and queried,” said Jeffrey Golkin, a tax certiorari attorney and adjunct professor at New York Law School who has represented building owners for 37 years.

PTS was designed to be more “user-friendly,” work with mobile devices and replace old main-frame systems.

PTS went live starting in February, and Finance Department reps say it was tested and retested numerous times.

Jackie Gold, acting assistant commissioner for external affairs at Finance, told The Post’s Rich Calder, “There are no systemic issues with the system. It’s a grand success. This is a big, big, big success. Of course, there’s always going to be some minor little technical issues that happen, but we work through them. We’re working through them and at the end of the day everybody’s going to get the full exemptions that they’re entitled [to] and we viewed this as a huge success.”

Finance says inquiries and service requests are also down from last year.

But sources say PTS missed crucial city billing and informational tweaks needed to adjust, review and pay bills.

“Their talking points don’t ring true because it’s too fresh,” Golkin observed. “People don’t notice things for months and there will be more fallout.”

Golkin added, “All of the July bills have irregularities with respect to any exemption, and it has created incredible confusion.”

Missing ICAPs — industrial and commercial abatements — and 421a abatements and exemptions are now being fixed. Those like Willis who overpaid can apply online for refunds, while those who paid using last year’s higher discount will be rebilled later.

But worse, except for three years, the online histories of payments — which are vital for backing into charges, payments, remission orders, refunds and credits — were eliminated along with 999 codes for specific items, leaving just a handful of notations. Finance staff can access info dating back to 1995, but doing so requires getting their help.

“It wasn’t evil motives, but the people who designed the system didn’t speak to the people who use it,” advised another source.

Created by Tyler Technologies of Plano, Texas, under a 2013 contract worth $18.4 million, the company also signed a $20 million contract in 2017 with New York state.

Some problems were created by others. The state legislature renewed the co-op/condo abatement after bills were mailed. Managers were told to pay up and have it fixed later.

Some 1,790 condo units lost 421a benefits before Housing Preservation & Development, which administrates the program, asked Finance to reinstate and fix bills for 185 properties.

But there were early red flags. When PTS first came online, “no one could figure out how to write checks.” Instead, electronic transfers of over $73.5 million were made for 4,821 properties.

But some paper checks now arriving have the wrong payees or amounts or co-mingle funds for several properties.

Condominium building refunds are bundled on one check — but without the previous spreadsheet showing how to apportion the money.

Other issues: Some large properties are being billed quarterly rather than semi-annually; old unknown charges are popping up, plus interest; and this year’s STAR exemption is being calculated differently.

“It’s made the inability to get the tax assessments and benefits correctly and created lots of confusion in the marketplace,” added Ken Lowenstein of Holland & Knight.