Tenants that are outgrowing co-working facilities are finding a variety of choices and building owners eager to roll out the red carpet. While jumbo leases by companies like Amazon and Facebook get all the attention, smaller tenants make up the majority of city businesses. They also sign the most leases each year. And building owners who cater to these companies are often multi-generational families who emphasize service and treat their tenants like family.

To put it in perspective, Cushman & Wakefield says over 5,166 new leases were signed in Manhattan from January through October of 2019. Of those, 3,922, or 75.9%, were under 10,000 square feet. Over the last five years, these small deals averaged 77.7% of all leases.

But they are overlooked. “The boutique buildings are driving the marketplace, and the 10,000-square-foot tenants are underserved,” says Daniel Blanco of Broad Street Development. Small tenants have different priorities and are laser-focused on price. But they also value attention to their needs and an understanding they can’t always afford attorneys and architects — or sign a 10-year deal.

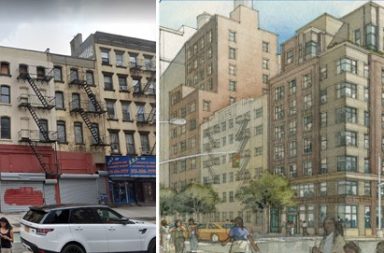

Just a year ago, Broad Street repurchased 312,000-square-foot 370 Lexington Ave. at East 41st Street for $190 million — $55 million more than the company sold it for in 2008 — and spent $30 million on upgrades.

With multiple tenants creating constant turnover and vacancies, Broad Street reduced a “regular” 60-page lease to 12 pages and started providing shorter deals — sometimes just one to two years. It also set aside a floor for the smallest tenants, who only needed 800 to 1,100 square feet.

Broad Street has since signed 30 deals totaling 65,000 square feet — with four deals in November alone. Those were consultancy Basis Research (for 3,300 square feet); fashion firm Slip (2,410), financial recruiters One Search (2,223); and investment advisor Clear Haven Capital Management (1,100).

Many companies that size have outgrown coworking facilities and are looking for office space that is both more self-contained and has a direct relationship with the building owner.

“Sometimes they speak about the chaos, sometimes they speak about the noise,” says Blanco, recounting the downsides of coworking spaces. “It’s also the cost. When you start going past 1,000 square feet, they can’t grow in WeWork because it’s expensive.”

While coworking offices provide flexibility, receptionists, copiers and kitchenettes, they may also, in some cases, cost nearly twice as much as leasing space directly from building owners. Blanco adds that his buildings have added some coworking-like amenities, such as shared printers, to make the switch even more seamless.

Along with coworking “grads,” Max Koeppel, director of leasing for Koeppel Rosen, is seeing activity from both global or national companies looking for satellite spots in New York. Koeppel Rosen is the managing and leasing agent for the Rosen family’s Manhattan portfolio and can accommodate a variety of different-sized tenants.

The biggest challenge for these small firms, Koeppel says, is finding the right-sized space, so he tries to create various opportunities within the Rosen’s buildings.

“When a tenant is going out, it opens the door for another to grow and take more space,” says Koeppel, who recently organized a space swap between tenants at 443 Park Ave. South.

Others grow and move to another building in the portfolio. For instance, Bowery Farming started out in 5,254 feet at 36 W. 20th St. and recently moved and expanded to 17,610 square feet at 151 W. 26th St.

Similarly, Grant Greenspan of the Kaufman Organization has witnessed the first generation of tenants to lease in their Madison Square portfolio growing out of those smaller buildings. Some, though, first expanded from 5,000 to 10,000 square feet.

“They are reaching a level of maturity and their leases are rolling, and they are now looking for 20,000 square feet on one floor,” Greenspan says. “But there is a steady diet of tenants looking, and we can backfill the spaces.” Kaufman’s buildings attract new firms with cool lobbies and artwork, he adds.

Small tenants also want certain amenities normally found in bigger buildings, such as bike rooms, advanced security systems, conference areas and outdoor space.

Adams & Co. recently installed a conference room in one of their larger properties at 110 W. 40th St. that can be booked by any tenant of their properties, most of which are clustered in Midtown South. The real estate firm uses the online platform Equiem for tenants to book the conference room, request maintenance or sign up for events.

David Levy of Adams & Co. says he constantly reassesses adding amenities but would rather upgrade bathrooms, elevators, hallways and lobbies over roof decks. That’s because, he adds, “In New York, it’s hot or it’s cold — it’s not that comfortable to be out there.”

Since smaller tenants also don’t have the capacity to take on a construction project, some buildings are adapting by providing options.

For example, Broad Street is building out spaces at 370 Lexington Ave. that can be adjusted to a tenant’s needs. Plans and renderings are on iPads and can be shown in 3-D, so tweaks don’t have to be shared with everyone on paper.

Building owners like Levy, Greenspan, Rosen and Blanco “want the retention” — they want tenants to sign one lease and then renew and grow in their buildings.

“When you treat them right,” Blanco says, “when it comes time to renew they don’t want to leave.”