New York City’s Finance Department is reopening a huge can of worms on completed deals to bring in additional taxes, causing havoc for REITs and shareholders.

Vornado Realty Trust is challenging a New York City Tax Appeals Tribunal decision that could cost it over $20 million.

Sure, you don’t care if a big company pays more in taxes these days, but you should. If you don’t own the stock in your 401(k), it might be held by a mutual fund you own or your retirement system owns.

This issue may also chill or decrease prices on large property sales.

The taxing situation revolves around the amount of transfer taxes paid to the city coffers when a property is sold.

For sales over $500,000, a “regular” seller would pay 2.625 percent of the value, while Real Estate Investment Trusts (REITs) get a special break of 1.3125 percent.

The half-tax amount was baked into the original 1990s New York state legislation that authorized the creation of REITs. The state and city wanted it to be less costly to move properties into public companies.

“Without the incentive, combined tax rates can reach as high as 3.025% of the ‘consideration paid’ for the property,” wrote Berdon CPA and attorney Wayne Berkowitz in March 2017, while applauding the original administrative law judge’s (ALJ) decision in favor of Vornado.

An audit of the 2011 sale of One Park Ave. had prompted the city to request additional taxes, which Vornado appealed to the ALJ.

But the ALJ’s decision was reversed in February 2018 by the NYC Tax Appeals Tribunal.

The city’s Finance Department had been routinely allowing the lower tax where various conditions were met — including the sale of at least a 40 percent stake.

This is a head-spinning calculation that includes the value of mortgages, mezzanine loans and other items. The tribunal has now ruled “compensation” should also include the transfer tax itself.

The REITs and the city were also using the beginning of a sentence in the statute stating the tax should be based on the city’s own “estimated market value.” This number is sent to the building owner each year for property tax purposes.

But the city’s tribunal decided the value should be based on the end of that sentence: “… or such other value that the taxpayer may establish to the satisfaction of the Commissioner.”

Since the city’s “estimated market value” is a well-known under-calculation, you can imagine the impact on taxes if the finance commissioner is only satisfied by say, the actual dollars paid.

The tribunal then recalculated the 2011 transfer tax for One Park Ave., which had previously been sold to other Vornado entities in 2007 for $550 million.

When the ownership was rejiggered in 2011, Vornado used the estimated market value of just over $240 million and paid nearly $3 million in transfer taxes. But that wasn’t enough for the needy city.

The tribunal decided the 2011 sale, along with transfers of various debt tranches, was really an extension of the 2007 sale.

By adding the transfer tax to the total paid, it recalculated the 2011 stake being sold at 39.13 percent — just shy of the required 40 percent stake.

At the higher tax amount, another $10.7 million was suddenly due. You can still hear Vornado Chairman Steve Roth cursing at the ruling.

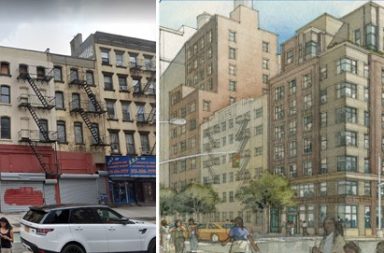

Suddenly an easy target, the city retroactively applied a larger tax to Vornado’s multi-step acquisition of a 50.1 percent stake in Independence Plaza in Tribeca – a complex with over 1,300 middle-income apartments.

When those transfers took place in 2011 and 2012, Vornado was the white knight keeping the properties out of foreclosure. No good deed goes unpunished.

Vornado now says it will cost $23.8 million or 11 cents per share for both deals, including the interest.

In 2015, the city also applied the higher tax to the November 2012 sale by Vornado affiliate Alexander’s of Brooklyn’s Kings Plaza mall.

According to city documents and deeds, another REIT, Macerich, bought the mall for a deed price of $276.9 million, paying a transfer tax of $3.6 million. (The city’s market value for 2012 was $259,976,000). Macerich also took over a $250 million mortgage and added another $250 million mortgage.

Alexander’s reported the price to stockholders as $751 million, plus $30 million in stock.

The city became downright giddy at the extra money to spend on bike lanes.

Alexander’s is now contesting the $23.797 million in additional taxes — $15.9 million for the transfer tax plus $7.9 million of interest — equaling $4.65 per diluted share.

These are not small numbers, and presumably, each party will appeal the result until the state’s highest court of appeals comes to an unappealable final decision – more years from now.

“Clearly, if the Tribunal’s ruling is upheld, more REITs are likely to face similar historic reassessments as well as will factor in higher transaction costs going forward,” wrote Alexander Goldfarb, a Sandler O’Neill analyst, in a note.

Vornado’s appeal on its One Park Ave. matter to the State’s Appellate Division is scheduled to be heard on Sept. 10, but that being the first day of Rosh Hashanah, it could be adjourned. Stay tuned.