A large Midtown air-rights transaction that allows JPMorgan Chase to develop a taller and bigger tower on the site of its current 270 Park Ave. headquarters has inadvertently stirred up questions about an investment in these air rights made by a group that includes one of the bank’s largest customers.

The group purchased the investment at a fire-sale price, records show, but sources advised those records are wrong.

To get itself a new and taller tower, JPMorgan is expected to buy around 680,000 square feet of transferable development rights for a price reported at “more than $350” per square foot — or $238 million.

The city would receive $47.6 million in tax revenue on the deal.

JPM is buying the air rights from a partnership that includes tech guru Michael Dell’s private investment firm, MSD Capital, and local real estate developers the Elghanayan family’s TF Cornerstone, and Andrew Penson’s Argent Ventures.

The JPM purchase is about half of a 1.35-million-square- foot swath of air rights owned by the three groups.

Each party declined to comment on the sale.

Penson purchased the air rights a decade ago for $59 per square foot — and soon after, recapitalized his investment by selling a stake to Fortress and Lehman.

Around 2015, sources said Penson exercised a buy-sell agreement, but needed new sophisticated investors who could understand the complexities of owning the land under Grand Central, its tracks and its air rights. In early 2016, a merchant banker brought in the nimble MSD which teamed up with locals TFC.

In July 2016, MSD and TFC bought out Fortress and Lehman — paying, according to records they filed with the city, $63 million, or $48.46 per square foot.

But the recorded price paid by MSD and TFC was a head-scratcher. So I dug in.

The real price is “much higher,” as sources now say the $63 million represented the purchase of each 45 percent stake owned by Fortress and Lehman. Along with Penson’s 10 percent share, the pricing came to $140 million, about $104 per foot. “The City register did not pick up the entire transaction,” a source said.

At the $104-per-square- foot price, the group will pocket — after a 5 percent fee paid to Grand Central Terminal — roughly $90 million, or about twice its investment in 18 months.

“King of Air Rights” Bob Shapiro of City Center Real Estate, said of the reported MSD/TFC purchase, “I have not done a deal for $48 a square foot for over 30 years.”

Before JPM decided to stay in Midtown, it conducted a long search for a new headquarters.

In 2014, JPM CEO Jamie Dimon backed out of a $6.5 billion Hudson Yards campus after incentives were denied by Mayor de Blasio’s administration.

Michael Dell spent much of 2014, 2015 and parts of 2016 working with JPM to finance and complete computer-maker Dell Inc.’s purchase of EMC for $67 billion — with Dell telling employees to “go big or go home, baby.”

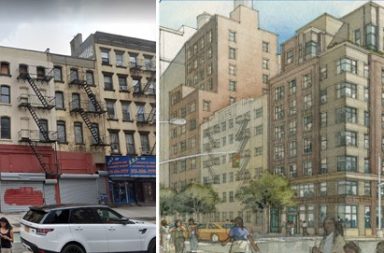

It is still unclear which party suggested its own “go big” idea or when the financial institution began exploring moving out all its employees, conducting the largest demolition ever — its 1.3-million-square-foot 270 Park Ave. — and rebuilding taller and larger on the same site, or when the JPM board gave it a green light.

In September 2015, Penson filed a $1.1 billion federal lawsuit against New York City and SL Green Realty Corp. after the developer paid $230 million for transportation improvements for a taller One Vanderbilt — rather than having to buy his air rights.

Penson, at the time, claimed the air rights were worth $880 per square foot. The suit was settled in August 2016 soon after Dell’s July air-rights purchase was disclosed.

At the time, SL Green CEO Marc Holliday said that “the new owner” had helped to settle the suit, which resulted in each side bearing its own costs.

Meanwhile, the updated East Midtown Zoning was churning text changes throughout 2016 and was approved by the City Council in August 2017.

By June 2017, JPM had already tripled its deal at 5 Manhattan West to 428,000 square feet as it prepared to relocate employees.

Without the incorrect TFC/MSD late transaction filing, Manhattan air rights in 2017 would have averaged $315 per square foot, commercial real estate data services firm Tenantwise found.

“For offices, air rights are now in the low-$300-per-square-foot range,” said M. Myers Mermel, CEO of Tenantwise.