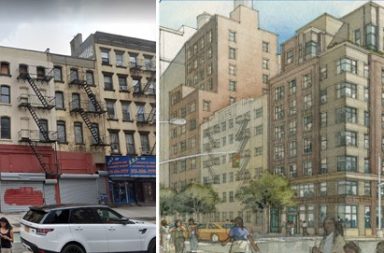

Nathan Berman’s Metro Loft rental conversion company has closed on the purchase of the long-term leasehold of the former New York Stock Exchange offices at 20 Broad Street.

The price was $185 million.

Deutsche Bank is the lender while the Vanbarton Group has provided preferred equity.

After plans have gelled, the 473,000 square foot building will be redeveloped into over 500 luxury rental apartments and a retail destination, Berman said.

The building had been operated as offices for the NYSE by Vornado Realty Trust which sold the leasehold through David Ash and Alexander Vial of Prince Realty Advisors.

As trading became more electronic, the need for the office spaces diminished, The Post’s Kevin Dugan and I exclusively wrote back in February that the parent company, IntercontinentalExchange Group, had decided to move out of the building. ICE later terminated the lease early — paying Vornado $15 million to do so.

Led by Jeffrey Sprecher, ICE had been cutting costs since the 2013 acquisition of NYSE Euronext.

But Atlanta-based ICE isn’t reducing NYSE’s presence at 11 Wall St., which was renovated and where its 221-year-old stock trading floor operates.

An affiliate of ICE remains as the owner of the ground at 20 Broad and will receive ongoing rent payments from Berman’s company. “Nathan is going to build a beautiful project,” Ash said.

Berman said the property has three “incredible” floors below grade with 17-foot high ceilings that will be combined with the ground and second floor to become roughly 100,000 feet of retail space.

“It will be a small, five-level shopping center,” he said.

The residential will be turned into a “very high end, white glove, upscale rental.” It will also have amenities that are likely to include a swimming pool, lounge and gym.

“The location is very special,” Berman continued, “as it is a half a block from the intersection of Wall and Broad, which is really the Times Square of the Financial District.”

The ground lease runs for another 65-years which has enough term to make the project viable, Berman said, adding, “It is very advantageous, and very long; my great-grandchildren will be dealing with it.

While he declined to further discuss the lease, it is still likely that at some point Metro Loft and ICE will be either talking about an extension or the outright purchase of the ground, which would bring in millions of dollars for ICE.

Meanwhile, Vanbarton is also the majority owner and Metro Loft’s partner in the conversion of 180 Water. Construction is now underway to convert the former office building into a 565-unit high end residential rental. That project by the East River will have similar upscale amenities along with a rooftop pool.

“Metro likes anything that is creative and interesting and elegant, with solutions that add value,” Berman said.

Lane Office Furniture will be moving to 256 W. 38 St., where it will have 17,220 square feet across the 5th and 6th floors of the 14-story building.

The furniture dealer and Knoll distributor will be moving and expanding in the Garment Center from 205 Lexington Ave. at East 33rd Street, where it has about 10,000 square feet.

Paul Davidson and Matthew Feigen of Newmark Grubb Knight Frank represented New York REIT, which had an asking rent of $50 per square foot for the space.

Neither Lane nor its brokers wished to identify who worked on their side of the deal, a spokeswoman for NGKF said.