Young prosecutors arrested a vendor based on the lie of one of NYC’s “Worst Landlords” and when he refused to plea, they lied to the judge, hid evidence, and suborned perjury to cover it up.

Calling the case “a grave injustice,” Alan Dershowitz has joined the legal team representing Ari Teman, a prop tech entrepreneur who has been under house arrest after a federal jury found him guilty of wire and bank fraud stemming from a payment dispute with his clients.

Evidence uncovered after the trial shows the prosecutors may have lied to the judge, jury and defense counsel, switched their accusations at the last moment contrary to the indictment so Teman’s defense team couldn’t prepare, let witnesses flee the country, and coached their main witness in the midst of testimony. One of Teman’s direct-competitors also lied his way onto the jury.

The prosecutors, who arrested Teman solely on the word of one of New York City’s “Worst Landlords” without any additional investigation, have since admitted Teman’s company had contractual authorization to draw the disputed telecheck payments that were the focus of the trial.

On the eve of trial, prosecutors blocked an expert witness from testifying by misrepresenting their case to Paul Judge Engelmayer and the defense, and also prevented their main witness from being thoroughly cross-examined about his years-long pattern of alleged fraud against tenants and the city by lying to the judge about the contents of transcripts and city violation records. Despite being ordered by Justice Engelmayer to thoroughly investigate their own witness’s testimony in a Housing Court matter and report back, the prosecutors either hid evidence or purposefully did not officially obtain it, so they did not have to share it with the defense team, which would be a “Brady” violation.

“What the prosecution did in the case is just outrageous,” Dershowitz said in a May interview with Breitbart News Sunday. “The main witness against them had a record of a lack of credibility, of lying and distortion and [the] prosecution withheld that, even though the judge told them to go and get evidence.”

Teman, founder of the artificial intelligence doorman intercom, GateGuard, has been in his Miami apartment since his January conviction in New York’s U.S. Southern District Court, wearing an ankle bracelet and wondering when his nightmare will end. Also a stand-up comic, Teman also does not see the humor in being under house arrest and losing his life’s savings all while facing hard jail time over a civil contract dispute with building owners that should have been brought to arbitration and not to the Feds.

Dershowitz and Teman’s original defense team are now seeking either an acquittal or a new trial. Unless the judge rules in his favor, Teman will be sentenced in New York on July 21.

In his first case since the acquittal of President Trump by the U.S. Senate, Dershowitz joined Teman’s legal team in February seeking to overturn Teman’s guilty verdict. Arguing in a motion, they wrote, “…if relying on a company’s contract constitutes a felony, every CEO is at risk of criminal exposure — and that is clearly not what Congress intended or what the law provides.”

This case features prosecutors so eager to send a guy to prison that they did not investigate thoroughly, were either too dumb or too lazy to understand or determine the real facts and perhaps later too dishonest or embarrassed to admit their mistakes. Now, they seem too focused on winning to care about justice.

This real-life scenario should scare the bejesus out of any tech company that has customers sign online documents authorizing automatic payments.

Gil Eyal, founder of tech company HYPR, a platform for hiring social media influencers, said, “It’s very scary to learn that a fellow founder may go to prison in America for following your attorney’s advice.”

How it Began : Teman attempts to collect what’s owed

For the better part of a year, Teman and his corporate counsel attempted to collect hundreds of thousands of dollars owed to GateGuard by a handful of landlords that still had the intercoms but were not paying their bills. GateGuard sells its video-intercom device through a financing model — similar to an iPhone — where customers pay a small amount monthly over a number of years so they can use the expensive equipment and use the service at an affordable rate. Like any major equipment financing, non-payment triggers penalties and fees.

The three clients in question stopped paying and evidence shows Teman and his corporate attorney, Ariel Renitz of Fisher Broyles, emailed the customers numerous times requesting the fees, involved a collection attorney, placed mechanic’s liens and sent itemized email invoices outlining the high charges for non-payment that were designed to recoup the cost of the equipment

Finally, after months of discussions between the two and numerous attempts to collect the past-due amounts, Reinitz advised Teman it was legal under the contracts to deposit 27 “telechecks” — also known as Remotely Created Checks or RCCs — into GateGuard’s account at Bank of America – one for each fee due as per contract, and altogether around $264,000 in the days before Passover 2019.

When the building owners noticed the charges after Passover they falsely told cops and their own banks — and even signed affidavits shown at trial — that they did not have any business relationship with GateGuard. Prosecutors later suggested Teman timed the deposits of the telechecks knowing that the customers would not do banking during the early days of Passover.

During the trial, the clients all admitted under oath they used GateGuard’s services and were made aware of the contract. All the usage and payment terms were provided during their online signup and had to be accepted for any installation work to begin — and they all still had the equipment in their buildings. Evidence also showed the clients had even copied sections of the contract terms either into emails asking Teman questions or for review by a condo’s board of directors which later approved the contract.

At trial, the jury was shown evidence that Teman used the funds from the RCC’s to pay his staff and his equipment suppliers in China. Bank records showed Teman did not take out cash for himself and was not even taking a salary at that time for running GateGuard.

Arrested without Due Diligence

Despite bringing the case to the grand jury twice, Assistant U.S. Attorneys, first Jacob Guttwillig and later at trial Kedar Bhatia, did not seem to do any due diligence until the eve of the January 2020 trial. Based on a motion, they did not even know or understand what an SEC-recognized Remotely Created Check (RCC) was until Teman’s attorneys named an expert witness.

The New York Police Department Detective who launched the case also never looked at GateGuard’s online customer contract that authorized the RCC payment method and advised calling the GateGuard phone number that is printed on every telecheck.

Nor did the detective call Teman before arriving unannounced at his office in Miami at 4 p.m. on Wednesday, July 3 to arrest him and seize documents. This left Teman in the city’s Federal Detention Center without Kosher food or a call to his attorney for days, as those that could authorize the call were gone for the long July 4th weekend. Denied medical care and marched for miles down concrete halls in chains on a severely injured foot, Teman had to be hospitalized repeatedly after the arrest, has been to multiple physicians without relief, and his doctors think he may have permanent spine or nerve damage.

Only on October 22, months after his arrest, and just hours after a hearing before Judge Engelmayer where Gutwillig read the RCC memo aloud in court, did Gutwillig first download GateGuard’s online terms. Even then, Guttwillig didn’t bother to research RCCs and remained uninformed even after a second superseding indictment, where in a Motion in Limine he described Remotely Created Checks as something Teman would have a “remote service” create, revealing his lack of understanding.

Instead, in a rush to prosecute, the prosecutors assumed Teman was a careless criminal who bought check stock online and printed “counterfeit checks” to pretend they were his customer’s own checks and then brazenly deposited them into his own accounts They even accused him of forging signatures — a charge they had to drop months later when bank records showed he had signed his own name.

Because they did not investigate thoroughly, the indictment language was explicitly about “counterfeit” checks and the prosecutors only realized their mistake long after issuing the indictments — when Teman’s defense attorneys Justin Gelfand and Joseph DiRuzzo named an expert witness on RCCs — at which point the prosecutors quickly changed the accusations and their own strategy.

The entire matter would have been prevented by the banks, if only they followed their own guidelines. However, since checking accounts are Federally insured and GateGuard’s checking account was flagged after the landlords disputed the telechecks, Teman was suddenly facing the feds. Perhaps if Gutwillig had opened an investigation before rushing to arrest, this whole trial would have been avoided.

Every bank officer who testified, from Teman’s Bank of America to the clients’ banks Signature Bank and JP Morgan Chase, admitted at trial that the RCCs were instantly recognizable and not “counterfeit checks” as the Feds had charged. Worse, they all admitted that if evidence authorizing the RCCs had been presented to them, they would have allowed the money to be drawn by Teman — but they did not bother to contact GateGuard to get that evidence, or to read the Terms at that same URL printed on every RCC.

Bad for Business

The case against Teman and the rush to prosecute should make anyone carefully consider whether they really want to run their own company in the United States.

Teman is a serial entrepreneur who founded GateGuard after realizing there was an unmet need for landlords to know who was entering their buildings. He is also a stand-up comic and likes joking around but when he discovered his Airbnb rental was used for an orgy that caused over $23,000 in damages, he was not only grossed-out but in 2014 founded a website, SubletSpy, to help others figure out who was really using their unit.

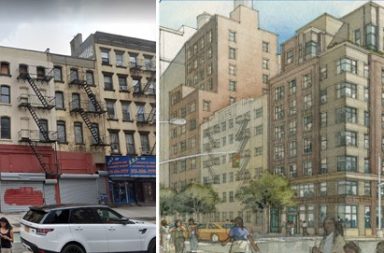

The success of SubletSpy soon led to Teman creating GateGuard which employs complicated artificial intelligence and proprietary hardware to identify and log everyone entering a building. For New York City landlords who suffer financial damages from illegal sublets and other lease abuses GateGuard was a no-brainer. If the building owner could prove in court a tenant was living in an apartment under an illegal sublet, running an Airbnb, or a tenant was missing, they could regain possession, fix up the unit and charge higher rents themselves.

GateGuard and SubletSpy serve hundreds of major landlords and have helped remove many illegal hotels and Airbnbs from New York City properties, and Teman has even aided the city’s enforcement agency in going after some of the worst violators who turn homes into illegal hotels.

In creating his company, however, Teman rightfully worried about getting paid, because many landlords have reputations for stiffing contractors. GateGuard’s online contract therefore includes numerous provisions to encourage payment. For instance, there are charges and large financial penalties for bounced checks, charge-backs, non-payment and cancelling of the services.

Teman’s contracts also state plainly, “You give us permission to write and sign checks with your checking and/or savings account(s) information to do a bank draw against your entity (or entities) for the amount it (or they) owe(s)” — thus allowing the RCCs.

Along with requiring arbitration for a dispute, in order to keep GateGuard’s clients from skipping out on payments, there is even a long section titled, “Agreement to not file chargebacks or fraud claims.”

To ensure the clients read the contracts, taking a cue from Van Halen’s “no brown M&M’s” rider clause to assure concert venues fully read the band’s contract, Teman even dropped a clause into his own contracts about Fleetwood Mac’s Stevie Nicks that would invariably be mentioned to him by those who actually read it. “You agree to never play any Stevie Nicks song in, near, for, or around any member of our team, or on any of our devices or networks. She really ruined that band,” the clause jokingly states.

No Criminal Intent – Followed Attorney’s Advice

In order to be convicted of bank or wire fraud, there has to be “intent” to commit a crime – and it has to be proven “beyond a reasonable doubt”.

Reinitz testified that he advised Teman that the use of the RCC’s was legal and authorized under his clients’ contracts. Reinitz also testified that he’d spent many months attempting to collect the funds from the three complaining clients via phone, emails and email invoices without success. These emails were in evidence, too.

The judge even asked, in the early days of the trial, why the prosecutor was bringing an indictment against Teman when there was a “defense of counsel” showing that Teman had acted within the instruction of his lawyers.

The prosecution also never proved criminal intent because Teman had involved his lawyer at every step, plus explained the RCCs to Bank of America (which says they deleted the video of his hour-long meeting even though they knew there was a criminal case pending), and disclosed the terms to the clients throughout the ordering and collections processes.

Reinitz not only testified but provided otherwise-privileged WhatsApp correspondence between Teman and himself that demonstrated he advised Teman that his actions were legal.

Teman’s WhatsApp messages also make clear he expected to prevail if the clients filed a civil case over the RCC drafts.

In January 2019, Teman wrote to Reinitz via Whatsapp, “Our contract states explicitly if you remove devices there’s an $18K fee, and we can draw from your account…we can print a check and draw your account…It’s legal…”

Reinitz replied that he should first notify the clients, lest they run to the police and report missing funds, saying, “And then you can start explaining about your contract and `not breaking any laws.’”

Teman took Reinitz’s advice, and had the attorney contact the clients via email and phone to attempt to collect payment over the next few months, long before depositing the telechecks.

The clients not only admitted on the stand that Reinitz emailed them and called, but the client who owed around $260,000 of the funds testified he’d asked Reinitz for “a release” from his contract but had been denied.

Bhatia later implied that Teman immediately disobeyed his attorney’s advice when in-fact Teman worked with his attorney for months on collection attempts. Without basis, Bhatia told the jury that Reinitz wasn’t “trustworthy.”

These attorney-client messages from January and April of 2019 were only allowed to be entered into evidence as Teman’s defense claimed he relied on advice of counsel to deposit the telechecks.

At trial, Reinitz testified he told Teman the telechecks were legal under the contract. “My legal advice was that it was legal, that the terms –GateGuard’s terms and payment terms — authorized Mr. Teman to deposit those checks,” he said. The government offered no witness to contradict this.

A Constructive Amendment, Bait and Switch

After Teman refused to plead guilty to the one-charge case, the prosecutors proceeded to heap-on additional counts in a superseding indictment, the one accusing Teman of forging his own name. The new indictment still specifically accused Teman of “counterfeit checks”, not “unauthorized checks”, and charged Teman with two counts each of bank fraud and wire fraud, stating, “to wit, Teman deposited counterfeit checks.”

Teman was defended by two young attorneys, Justin Gelfand, of Margulis Gelfand of St. Louis, a former AUSA and Teman’s college friend from Brandeis University, along with Joseph DiRuzzo of Ft Lauderdale.

During the New York trial, they worked out of a tiny hotel room, with no paralegal, no copier and no support staff; often working past midnight during trial to prepare large binders and memos demanded by Judge Engelmayer.

Gelfand and DiRuzzo came to trial in New York prepared to prove there was no counterfeiting or forgery — to defend against the counts as written in the indictment.

The team proposed calling J. Benjamin Davis, a North Carolina attorney, as an expert RCC witness. Davis told me such RCC’s are cheaper for online merchants and telemarketers to use than the Automated Clearing House (ACH) system — where a company takes payments directly from your bank account as these incur a percentage fee to the merchant. RCCs are very common in real estate and other recurring-fee businesses like GateGuard’s, as they prevent the “checks in the mail” stories and allow timely payment processing, just like ACH but without the fees.

But Davis was blocked from testifying by Bhatia who may have now realized his mistaken charges, saying his testimony “risks confusing the jury.” In fact, it had confused him because now the charges based on the indictment were wrong.

Since Bhatia no longer had a counterfeit case, he then claimed that the term “counterfeit” was a broad term and that he and Gutwillig did not really mean “counterfeit” specifically.

In doing so, the prosecutors unconstitutionally changed the case, Dershowitz’s team explained. The prosecutors never called the RCCs “unauthorized checks” in any indictment and were very clear the case was about forging fake checks and forging signatures until Davis was proposed.

Bhatia and Gutwillig had even fought in motions to keep in evidence the blank check stock, taken from Teman’s Miami office, because they wanted to prove Teman didn’t use a “remote service” to make the alleged forgeries. Until Davis was named and long after the superseding indictment, this was clearly a case about knocking-off checks, not authorization.

Prosecutors are not permitted to make an accusation at trial that is not in the indictment. In its motions, the Dershowitz team explains that during the trial, the prosecutors only presented evidence of “unauthorized RCCs.” This would be an unconstitutional Constructive Amendment of the indictment. “The bottom line is this: an RCC—even if unauthorized—is not a counterfeit check,” Dershowitz’s team argued.

Davis, who advises financial institutions on RCCs, said the Government’s accusation that Teman deposited “counterfeit” checks are baseless. “It’s not a forgery, which is impersonating the account holder.”

Fighting tooth-and-nail to keep the Grand Jury minutes from being disclosed, Bhatia wrote, “all of the discovery, argument, and proof has focused on whether or not Teman’s checks were deposited with authorization.” Yet in new motions and letters to the judge, Bhatia now admits Teman’s company had a contract authorizing those deposits.

Still out to win at any cost, it is unclear why faced with the real evidence, the government doesn’t move to dismiss the case and is instead still insisting that if you rely on portions of a multi-page online contract you could be charged with criminal acts should a client change their mind.

Bhatia Concedes RCCs Were Authorized & NY Court Upholds GateGuard’s Terms

Once Dershowitz joined the defense and pointed out the flaws in the government’s case, Bhatia conceded in a letter to Judge Engelmayer that GateGuard’s terms do allow the drafting of these RCCs, but claims they are “buried” in the contract. They are “…buried a disclaimer deep on his website that would give him a bogus cover story to draw checks from his customers” Bhatia wrote.

GateGuard’s terms, however, are in the same format as many major online services, with subsections like Privacy, Dispute, and Payments all being broken into sub-pages for easy reference.

In May, a New York State Court even upheld the validity of GateGuard’s online contract terms and sent another past-due client to arbitration in-accordance with the Dispute subsection, which is linked exactly like the Payments subsection. The Subsection, which authorized the RCCs, is one click from the “Terms” in a bright blue link, and at trial all clients admitted to seeing it, saying they “chose” not to click it or “don’t remember” if they clicked it.

Bhatia Hides His Witnesses’ History of Fraud

In another duplicitous act by prosecutors, Justice Engelmayer ordered Bhatia to thoroughly investigate a Housing Court matter to determine if the landlord who was to testify against Teman had “interacted” personally with a 72-year-old disabled man to defraud him out of his rent-regulated home. If he had, his fraud was “coming in” and Teman’s team could thoroughly cross-examine the landlord about it, the Judge ordered.

Bhatia later told the judge there was nothing there, and so the cross-examination was barred and Teman’s team had no reason to suspect anything but the true facts from Bhatia.

Bhatia also later confessed to coaching his main witness and the man who launched the case after court was adjourned for the night in the midst of his testimony. That is another grounds for acquittal, Dershowitz’s team argued in their motions.

After the trial, however, Teman’s team went through a long process to obtain transcripts of the Housing Court case (NY Housing Court cases are not online) which detailed that the landlord had indeed had personal interactions with the tenant in numerous ways, including pointing out other apartments, illegally informing the tenant that the company wasn’t allowed to renew his lease, and even handed him documents to sign and a check to give up the unit while inside the tenant’s apartment.

When prosecutors were confronted with a “Brady” motion by Dershowitz for withholding this evidence, Bhatia wrote he never had the transcript to suppress, quipped in a footnote that Teman could have obtained the transcript, and later admitted the landlord had interacted with the tenant.

Dershowitz told Breibart the prosecutor has, “an obligation under Brady to try to find out events that might show – cast doubt – on the veracity of the witness, and they sat on their hands, and the evidence that basically proves his innocence didn’t come up until after he was convicted. And so now the issue is being raised.”

Bank of America Screws Its Own Customer

All bank officers who testified, from Teman’s Bank of America to the clients’ banks, Signature Bank and JP Morgan Chase, admitted at trial that the Remotely Created Checks were instantly recognizable as RCCs and not “counterfeit checks” as the Feds had charged Teman. They also admitted the 24-hour period for the clients to file chargebacks had long passed and they weren’t required to reverse the funds. Worse, they all admitted that if evidence the RCCs were authorized was presented to them, they would have to reverse the reversal — but they did not bother to contact GateGuard to get that evidence.

Bank of America’s Senior Fraud Investigator Karen Finocchiaro confessed on the stand that she also did not read GateGuard’s terms, saying the company’s firewall blocked her access. She testified she did not try to open them on her own iPhone, and did not bother to contact her bank’s own longtime customer, Teman, to ask about the RCCs, despite the phone number also being printed on the RCCs in a “Note to bank” memo.

Finocchiaro said Bank of America honored the chargeback request of the landlords’ banks even though they had passed the 24-hour deadline to request a chargeback, meaning none of the banks were required to return the funds to the landlords.

Worse for Bank of America, Finocchiaro admitted that putting a hold on all of Teman’s funds in his other accounts, including SubletSpy and GateGuard’s parent company Friend or Fraud, and his personal accounts, as they did, was illegal. Bank of America finally cut checks and returned the funds to Teman after trial, but the damage caused by illegally taking the funds was already done, crippling Teman’s companies ability to operate or grow.

More Perjury & Banking Regulations Ignored

Bhatia’s number-two witness also admitted during clever cross examination by Gelfand that his family member had perjured himself on a bank affidavit to get their money back from GateGuard. That family member had told the bank he didn’t know who GateGuard was and had never owed GateGuard money, despite emailing his brother-in-law about Teman that same day and having written a check to GateGuard not long before, from the same Signature Bank account.

The brother-in-law flew to Israel after his affidavit came into evidence, despite Teman’s team subpoenaing him to testify.

Another woman, also a Signature Bank client who was subpoenaed by the defense, also didn’t comply.

Signature Bank also admitted their automated system failed to detect the RCCs, and that while their humans did instantly recognize them and requested their clients fill-out affidavits, they took those affidavits at their word and did not call or investigate further, or even to look and see that same account had obviously owed GateGuard money before and written a check because of it.

Chase Bank’s rep also did not read the GateGuard Terms or call GateGuard before processing their client’s chargeback request, despite it being past a 24-hour deadline, which their customer blamed on Passover. They claim they do not know if the affidavit they required of their client, the main witness, was never filled out as required, or was disappeared.

Coercive Plea Bargaining with Zero Evidence

In a superseding indictment claiming Teman forged the landlord’s signatures, the prosecutors tried adding a charge of Aggravated Identity Theft — which has a four-year mandatory minimum sentence. They then tried to get Teman to plead guilty to avoid years in jail. However, when the two prosecutors finally bothered to get the actual bank documents, they realized Teman had signed his own name, just as it appeared on every form he’d filled out for years.

After Gutwillig could not name any alleged victim of identity theft, Judge Engelmayer chastised the young prosecutors in court, threatened to “Rule 29” the counts, meaning remove them for lack of evidence, and the young AUSAs dropped those counts.

The Cato Institutes’s Clark Neily has written that it is standard practice for prosecutors to avoid trying a case by stacking counts which coerce defendants into pleading out of fear of long sentences. In fact, only two percent of all Federal indictments ever make it to trial, and many of those are found to have prosecutorial misconduct. Neily gave a recent example on twitter, “Peak DOJ: They threatened Lori Loughlin with 20 years and settled for 2 months. Hope everyone understands they do that to not-rich/not-famous/not-political people too. In fact, that’s mostly who they do it to.”

Questionable Jury & Jury Instructions

Even more shocking, a direct competitor to Teman, who also runs a compliance-monitoring platform targeting the same New York City clientele as Teman’s PropertyPanel platform lied to the Court during jury selection saying he didn’t know Teman and had no conflicts. In fact, he’d requested Teman on LinkedIn more-than a year before trial, and had frequently shared articles from The Real Deal, which broke the story of Teman’s arrest. With Teman in prison, he’d eliminate one of the biggest competitors in his niche market. The defense team says this, too, is grounds for a new trial.

As well, invoices and emails requesting payment from the landlords were also entered into evidence, yet the jury instructions also wrongly stated: “Defendant Never Invoiced Customers.”

The jury instructions also failed to include the part of RCC regulations that allow a contract to authorize all future RCCs without individual authorization. Instead, the Judge cropped the regulations short, to imply that every RCC would need independent authorization from the clients — which in practice would render RCCs relatively useless, and isn’t the law.

In Judge Engelmayer’s Hands

Unless Justice Engelmayer rules in his favor for a new trial or acquittal, Teman — who is understandably freaking out about his situation — could face years in jail and fines for billing his clients according to his company’s contract and lawyer’s advice.

Even if Teman prevails as Dershowitz predicts, the law makes it nearly impossible for a defendant to recover legal fees even when they win, meaning Teman’s legal bills will almost certainly be far greater than the alleged loss from the chargebacks.

When reached, Bhatia referred comment to the U.S. prosecutor’s press reps whose phones have been unable to take messages for weeks.

“There’s been a grave, grave injustice here”

Teman is also the founder of the JCorps volunteer network, which sent hundreds of young adults from 180 colleges and 800 companies to volunteer in soup kitchens, childrens’ hospitals, special needs programs, senior centers, parks and animal shelters. For his unpaid work with JCorps, he was named the North American Jewish Community Hero by the Jewish Federations of North America and honored by the Obama White House and New York City’s Mayor Michael Bloomberg. While Teman is a vocal supporter of President Trump and Israel, Dershowitz has said he was unaware of Teman’s political views and agreed to take the case because of the wrongful verdict.

“I think there’s been an injustice here,” Dershowitz told Breibart. “And there’s been a grave, grave injustice here and I hope it will be reversed.”

UPDATE: Friends of Ari have set up a GoFundMe to support his legal fight: https://www.gofundme.com/f/justice-matters-ari-teman-legal-defense-fund.