Slow but steady commercial sales have been dragged down by affordable housing regulations and an ongoing lack of trophy-building offerings.

Building owners are reluctant to sell as they worry about reinvestment opportunities. The lack of specifics about President Donald Trump’s tax cut proposal, coupled with a long economic uptick and a booming stock market, has also made real estate executives wary of a possible bust ahead.

“People are mindful of the fact that we are late in the [boom-bust] cycle,” says Woody Heller, executive vice president and co-head of capital markets at Savills Studley.

Multifamily properties are still selling at low capitalization rates — which translates into low returns for buyers compared to their purchase prices. Thankfully, there is still financing available.

It’s also a tough time for such building owners as the rental housing market has been subjected to two years of rent freezes on stabilized apartments and the city has passed numerous laws to prevent tenant buyouts and harassment.

The market for rental buildings “hasn’t been affected despite [Mayor Bill] de Blasio’s attempt to kill it,” says Peter Hauspurg, chairman of Eastern Consolidated.

And there are completed transactions to prove it — as well as ones in the works.

The Vanbarton Group is in contract to buy residential apartment tower The Vogue at 990 Sixth Ave. for $318.5 million through Douglas Harmon and Adam Spies at Cushman & Wakefield. The same brokers also sold the group’s 180 Water St. to Metro Loft Management (which had been Vanbarton’s ownership partner) earlier in the year for $450 million.

Also through Harmon, South Brooklyn’s multi-building complex Starrett City is also in contract to be sold to the Brooksville Company and Rockpoint Group for $850 million. A lawsuit has been filed by longtime stakeholders who also want to buy the middle-class residential enclave, so it is unclear if that trade will close next April as scheduled.

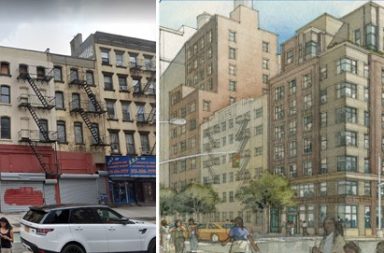

The city also has a new tax incentive program for developing residential housing, known as Affordable New York.

“Developers are determining how they can best utilize the program for their new projects,” says attorney Michael Lefkowitz, a partner with Rosenberg & Estis.

Some good news for property buyers: Despite a lack of velocity and volume, Cushman & Wakefield still saw capitalization rates drop 25 basis points to 4.02 percent, highlighting buyer demand and a willingness to pay up for certain assets, even in a declining market.

“The logjam has been broken by a strong, nimble supply of investment capital finding owners who want to harvest profits or take advantage of today’s sellers’ market,” says Harmon, chairman of Cushman & Wakefield’s capital markets group. “It’s tough, when values are so strong, to sit on the sidelines for too long.”

Things are looking up. Although overall sales volume is down by 60 percent, the number of sales in the fourth quarter could equal those made during the first three combined, according to Andrew Scandalios, senior managing director of HFF. “Rents are softer, yields are down and construction costs are up,” he adds.

“We’ve all lived through it before — and it will come back — but it is a challenging market,” says Richard Baxter, vice chairman of Colliers International. “The good news is that everything is selling, and the prices haven’t come down at all.”

Earlier in the year, most of the larger office trades went to Asian investors. Among the big trophies were the $2.21 billion sale of 245 Park Ave. through CBRE to Chinese conglomerate HNA; and a 95 percent stake in 60 Wall St. for $1.05 billion through HFF to US-based Paramount Group and GIC, the Singaporean sovereign wealth fund. A 49 percent stake in SL Green’s 1515 Broadway through Cushman & Wakefield, which values the building at $2 billion, is still in play and expected to go to a Chinese company.

For its part, Colliers International marketed three pending deals: the sale of 19 W. 44th St. for $195 million to Savanna; the Fine Arts Building at 232 E. 59th St. trading to the Kabbalah Centre for about $60 million; and an office and retail condo at 86 Chambers St. that is in contract to TH Real Estate for a reported $67 million.

Darcy Stacom’s group at CBRE sold 685 Third Ave., owned by TH Real Estate and Australian sovereign wealth fund the Future Fund, for $467.5 million to Japanese company Unizo Holdings.

Now that its vacancies are filled, Scandalios at HFF is relaunching the marketing of 5 Bryant Park, which could sell for roughly $700 million. HFF is also marketing the fully leased retail condo at The Edge building on the Williamsburg waterfront, which should trade in the mid-$50 million range.

“Once tax reform happens, you will have a more vibrant sale market,” says Leslie Himmel, a partner with office building owners Himmel + Meringoff. Because of the uncertainty surrounding the tax reform, she adds, “You can rely on nothing until it’s completed.”

Office building trades are also challenged because there are millions of new square feet being developed, especially on the far West Side by Hudson Yards. Midtown companies are moving there as they give up more dated spaces for new ones.

Despite employing more people, companies are generally taking up less space. That phenomenon is putting a drag on the value and sales of older buildings. It finally spurred the passage of the Midtown East rezoning proposal, which allows owners with older buildings — most over 50 years old — to demolish and rebuild them to create structures fit for the modern era.

Pfizer is already taking advantage of that law with representation through Cushman & Wakefield.

The pharma giant is expected to move its headquarters to 800,000 square feet in the upcoming 2.85 million-square-foot Tishman Speyer tower at Hudson Yards known as The Spiral.

Pfizer will then sell its current full block at 219 and 235 E. 42nd St., near Third Avenue. Best and final bids are due the first week of November.